First up, what are credit cards? Glad you asked. They’re a gateway to a world of near infinite riches and treasure, and at the same time, bottomless debt stored on a plastic card housing a microchip.

Nah, just kidding. 😜

Credit cards are simply cards that empower you to buy now, and pay later. This is similar to debit cards or what everyone calls VISA cards in Ghana with a few exceptions.

👂🏾 What was that?

You’re asking about the difference between debit and credit cards?

It’s simple actually. Debit cards give you access to your own money – the one that’s currently in your account – to spend how you want. This could be online transactions, at an ATM or using a POS.

Credit cards on the other hand are short term loans. So unlike debit cards, you’re not spending your own money but the bank’s which you’ll have to pay back. Paying back is usually after 45 days, and for most banks, it’s only after this period that your card starts attracting interest fees.

Second question. Are there credit cards in Ghana? Yup! If the title didn’t give it away already, the answer is yes. And no, we’re not referring to debit cards. You know, the one that every bank in Ghana offers account holders by default?

Okay? Do people actually use credit cards in Ghana?

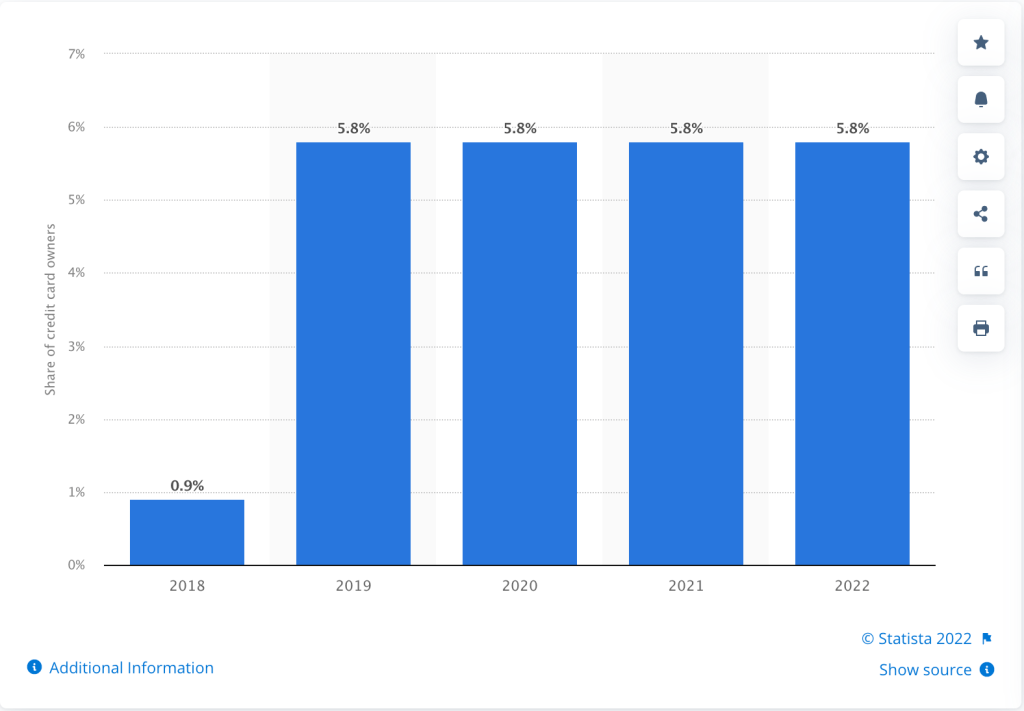

Actually, yes. Although, it’s only a small chunk of Ghana’s population that uses credit cards. The chart below shows the trend from 2018 up until this year. About 1.7 million Ghanaians use credit cards. That’s 5.8% of Ghana’s population. Whew!

How to acquire a credit card in Ghana

There are generally two options.

- Go to your branch/contact your relationship manager, fill a form, meet eligibility requirements and wait.

- Apply online, either via a website or in the case of Standard Chartered bank, via their SC Mobile app.

Banks That Offer Credit Cards in Ghana

Credit cards aren’t new, and there are quite a few banks in Ghana that offer them. And no, you don’t have to be earning a truckload of money to qualify for them (that’s for the rich rich and they’ve got credit cards tailored specifically for them). There are generally 4 credit card networks globally. These are Visa, Mastercard, American Express and Discover. Visa and Mastercard are the only types in Ghana however. These are issued to you depending on your bank.

Let’s get into the banks.

Standard Chartered Bank

Standard Chartered Bank promises a world of privileges with its VISA credit cards. The bank has positioned itself as the de facto credit card provider in Ghana. Beyond offering you a quick and easy soft loan, this credit card also enrols users into the bank’s Rewards program. You earn points on transactions which you can later redeem on flights, in shops and in restaurants.

🖐🏾 Hold up! Don’t get turnt just yet. You’ll need some big spend to accrue enough points to truly enjoy the benefits.

Eligibility Requirement

The minimum income requirements are GHS1,000 for Classic Credit Card and GHS22,500 for the Visa Infinite Credit Card.

Ecobank

Ecobank is the OG, the premiere credit card plug in Ghana. Ecobank introduced the first ever credit card facility in Ghana back in 2007. It started off as a card for high net-worth individuals and government officials. It’s unclear if that’s still the case since it doesn’t publicly list minimum income requirements to be eligible. Instead, applications are treated on a case by case basis

That notwithstanding, Ecobank has two types of cards, the Advantage Gold Credit Card and the Premier Platinum Credit Card.

Eligibility Requirements

- Have a current account with the bank, active for no less than 6 months

- Be a salaried worker

Learn more here.

Republic Bank

Interestingly, this mortgage and home finance bank offers credit cards too! It’s the newest kid on the block, having launched its Fantastic Four cards just two months ago in May.

While most banks offer two types of credit cards for various income brackets, Republic offers 4. These are Adehye (royalty), Classic, Infinite and Business. Republic’s cards offer cash back rewards which could come in handy later on.

Republic’s whole position on their credit cards is that life is now! They’ve even got a snazzy video touting all the reasons you should use their credit cards.

Learn more about Republic’s credit card offering here.

Eligibility Requirements

Your monthly income should be at least GHS1,500.

Below are the different tiers for their four cards.

- Classic – GHS1,500

- Adehye – GHS5,000

- Infinite – GHS15,000

- Business – SMEs with minimum monthly account turnover of GHS 500,000

GTBank

The orange bank also offers account holders a credit card called World Card. GT offers some extra benefits on its card like travel insurance and medical insurance up to $500,000 🤑. GTBank’s card is powered by Mastercard and this comes with some extra perks.

Cardholders get complimentary hotel bookings at select hotels and resorts. They also get exclusive airport Lounge access as well as Herts Gold Plus membership for car rentals.

The eligibility requirements for this card aren’t clear so you’ll need to contact the bank or your relationship manager directly for all the deets (that’s details for you uncultured folks).

Learn more about GTBank credit cards here.

ABSA

ABSA first introduced its credit cards back in 2016, when it was Barclays Bank. At launch, Barclays made sure to cater to both low and middle income earners, to steal market share from Ecobank.

The minimum income requirements for ABSA are GHS1,000 for Classic Credit Card and GHS55,000 for the Platinum Credit Card.

ABSA offers several avenues to apply for this card. It can be directly on their website by filling a form.

Eligibility Requirements

- For existing customers, an account which has been active for no less than 6 months.

- For new customers, 1 month account balance.

Stanbic Bank

Launched back in 2019, Stanbic Banks’ credit cards have a higher entry bar and are arguably, the most premium service out of the lot. The minimum monthly income to be eligible for this card is GHS3,000.

Stanbic offers 3 credit card products, Silver, Gold and Platinum with credit limits up to GHS75,000. There’s a fourth, Business Credit Card, which is available to all Business Banking customers.

Learn more about Stanbic’s credit card options.

Zenith Bank

Zenith Bank offers two types of credit cards powered by VISA and Mastercard. There’s the VISA Classic Credit Card and the Zenith Mastercard Platinum Credit Card.

The requirements for either card is not readily available and is treated on a case by case basis. To apply, you’ll need to reach out to the bank directly.

Eligibility Requirements for Credit Cards in Ghana

Each bank has unique requirements to qualify for a credit card. There are some general requirements however that cut across listed below.

- Be 18+

- Be a salaried worker (with proof of income, typically pay slips)

- Be guaranteed by your employer*

- Have a current account with the bank

- Your account must be active, typically for at least 6 months

Should You Get a Credit Card?

Like so many things, it depends. This is similar to the question of whether or not to get a bank loan in Ghana, especially for personal unsecured loans. Several factors affect your decision to get a credit card.

Why/When You Should Get A Credit Card

1. Instant Emergency Support

Got an emergency that requires some quick cash? Credit cards can be a saving grace as they cushion you in the moment so you can get your act together to financially deal with your emergency.

2. Builds Credit

Helps you build credit and a good credit score. This is particularly useful for entrepreneurs and business people who need loans to scale up their businesses. A good credit score shows banks you’re legit, can pay back and won’t disappear with their money.

Beyond business, it’s also helpful when you’re applying for a mortgage, which require more money to apply for in Ghana than is practical.

3. Increased Purchasing Power

Gives you the room and flexibility to spend on the things that matter now. Like Republic Bank is touting, life is now and it doesn’t hurt to bamba and chill with the big boys, even a wee bit.

4. Insurance

Some cards come with protections such as travel and medical insurance. They also come with some level of credit card fraud protection where banks can respond faster to illegal transactions with your card, and you don’t lose that money. This is unlike a debit card where it can be a nightmare to get those funds back.

5. Cash Back, Rewards and Discounts

It can be a real pain knowing all your bank does is deduct fees from your account.

Why You Absolutely Mustn’t Get a Credit Card

1. Debt and More Debt

Having a seemingly infinite pot of gold to spend can and will quickly spiral into a bottomless pit of hell, brimstone, gnashing of teeth and the mother of all disaster, uncontrolled debt, if you’re not careful. Best be cautious and not be lulled into a false sense of “I got money” else you’ll only end up broke, and forever paying back your debt.

2. If You’re an Irresponsible Psycho

If you’re irresponsible, you absolutely shouldn’t get a credit card. You’ll just spend recklessly and burden everyone around you when it comes to paying back. The banks are happy when you spend recklessly, but your parents, friends, workplace and family won’t be. Cause it’ll become their headache.

3. Accrues Interest

All that spending ain’t free. In addition to paying back what you’ve borrowed, you’ll need to pay some interest as well.

4. Poor Spending Habits and Living Completely Beyond Your Means

Say you earn GHS1,000 but get wasted every weekend at Bloom Bar on a bill of say GHS500. What’s left for your feeding, clothing and transportation in this country where prices soar and never come down like the ridiculous lies of Ghanaian politicians?

‘Nuff said.

5. Encourages Impulse Buying

Want those new Chuck Taylors that just came out for $250? Simply swipe your card. Oh that fancy restaurant that just opened up at Dzorwulu? Let’s go try it.

With increased purchasing power, you almost forget that you’ve got money to pay back and just indulge your fantasies. Credit cards can and will put you in this trap if you’re not careful.

How Do I Use Credit Cards Responsibly?

A good rule of thumb for using credit cards responsibly is not to use them for impulse purchases or unaffordable items if you cannot pay it off within a reasonable amount of time.

Discover.com

Taking a page out of Discover’s advice on responsible credit card use:

Like most financial products, the advantages of credit cards are best enjoyed when cards are used responsibly. It is essential for anyone who decides to open a line of credit to consider how they plan to make the payments and how to use their newfound purchasing power responsibly.

It can be beneficial to use a credit card for purchases that allow for the balance to be paid off within a reasonable time frame. If there is no plan to pay off the balance, however, it will likely continue to accumulate interest, reduce spending power and potentially limit the benefits of having a credit card.

What About Prepaid Cards?

Some banks, like First Bank offer prepaid cards, which can get a little confusing. Are prepaid cards the same as credit cards, or are they just another name for debit cards? 🤔

Unlike a debit card, a prepaid card is not linked to a bank account. Generally, when you use a prepaid card, you are spending money that you have already loaded onto the card.

Buuuut, this post is on credit cards so we’ll leave that for another post. Click to read more on prepaid cards, and how they’re different from what we’ve covered here.